Today's Mailbag...

After last night's post about the evils of credit cards, I found three items of interest in my mail today.

One was a ~pre-approved~ brand spanking new credit card application.

Another was some more of those blank checks that the credit card companies send out all the time.

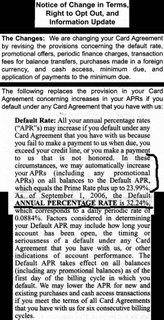

And the third item was from Sears.

Inside was some of those tiny lettered words on small pieces of paper...

You know, the kind of stuff that you just glance at and throw away in the trash.

Well today I took a little time to stop and read the thing.

And it was a pain too...

Because I had to use those pharmacy reading glasses of mine to read it.

It seems that Citibank is taking over the credit card business for Sears...

And among the many benefits that you will enjoy as a Sears card holder is Citibank's special "Default Rate".

I'm sure you guys have heard of default rates before?

It's one of those things that if you screw up and don't pay your bill on time...

Or anything else that would keep your payment from being posted on the exact day and hour that it's supposed to.

If this should happen...

Let's say you were in the hospital for an emergency appendicitis.

Then the interest rate on your account would automatically go up.

In this case, Citicard is stating that as of September 1, 2006, the default interest rate is...

32.24% APR

Yeah...

That's what I said too.

How many people read the bottom of their credit card bills to see what the interest rate is?

How many people just suck it up and pay the late fees and think nothing else about it...

Not realizing that their interest rate has just hit the roof?

It's all in that itty bitty fine print.

It's there to get you when you're down...

And it's designed to keep you down.

A new credit card to try out.

Some blank checks to use 'cart blanche'...

A new 32.24% APR default credit card rate?

Priceless.

later...

9 Comments:

Credit cards, how can we live with them, how couldn’t we live without them?

Legalized loan sharks!

Hey Angela...

I'm going to do my 'darndest' to live 100% without them.

If I could put all the money that I have paid out to credit card companies into savings...

or even buried it in my backyard...

I can't even imagine the things that I would be able to do.

Hey Lea...

Exactly.

later...

I think it is terrible that credit cards are so available - those who are the most desperate will be the ones who end up in even more misery and debt. The interest rate is disgusting - many people just don't understand how much it is that they are paying back on top of what they owe. Good job on bringing this to our attention.

Now, if only....I practiced what I preach....

Sue

Now, if only....I practiced what I preach....

Lord...

Don't we all need to do that!

later...

That is outrageous! 32%? Are they nuts?

You know, I do have a few credit cards myself. Fortunately, my credit rating is high, so I qualify for a low APR. I think mine is about 6%, which isn't too bad considering.

BUT, those high APR's just take advantage of people.

Hey Pattie...

I have some low APR cards too, but...

Read that fine print.

If you make a mistake you could be looking at 30% on your next bill!

later...

I almost choked when I read that! I thought the 26.99% that Chase is so fond of was bad enough ...

That's just incredible! *grrrr*

It IS incredible Moof!

Post a Comment

<< Home